Income statements

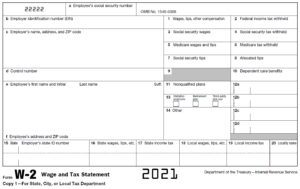

W-2 form is an official tax document also known as the Wage and Tax Statement. An employer is obliged to send this document to each employee and the Internal Revenue Service at the end of the year. A W-2 reports the annual wages of employees and the amount of taxes withheld from their paychecks.

W-2 form is an official tax document also known as the Wage and Tax Statement. An employer is obliged to send this document to each employee and the Internal Revenue Service at the end of the year. A W-2 reports the annual wages of employees and the amount of taxes withheld from their paychecks.

At the end of a fiscal year, employers are required by law to provide to their employees a W-2 Form which contains information about the annual earnings and paid taxes. This form is the most important one for getting a tax refund. The number of W-2 forms should be equal to the number of jobs one had in the USA. Employers are legally obliged to postmark and send the W-2 forms to their employees no later than January 31 of the following year by regular mail.

In order to make sure that the employer sends the W-2 form to the right address, it is of the utmost importance to correctly fill out the W-4 form when being hired. The address listed in this form is the address to which the W-2 form is going to be sent.

If you do not receive a W-2 form at the end of the year, you can claim your taxes by submitting your last pay slip. Pay slip is a part of a paycheck that remains in your possession after cashing the check. The final paycheck, i.e. pay slip, contains the same information as the W-2 form, which is why it is important to save the final pay slips from all of your employers.

Important: Pay slips are not documents intended for filling out a tax return, and filing them out instead of your W-2 form can cause complications and extend the whole refund process.

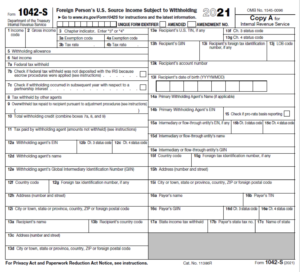

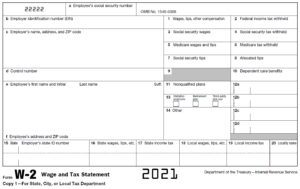

1042-S form shows the income of a nonresident subject to taxation in the USA. It is used to report amounts paid to nonresidents by an institution or company based in the United States.

1042-S form shows the income of a nonresident subject to taxation in the USA. It is used to report amounts paid to nonresidents by an institution or company based in the United States.

For example, if you work as a freelancer for an American company, at the end of the year you will receive a 1042-S form from that employer on the basis of which you can make a refund of part of the tax paid.

Every US company that employs a non-resident, if it has not signed a Tax Treaty with the home country, is obliged to withhold 30% of the income tax.

When hiring, the employer will send you a W-8 form that you are required to complete and send to the employer. It is very important that you provide the correct information on the W-8 form to get the 1042-S. Instructions for filling out this form can be read here.

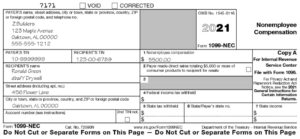

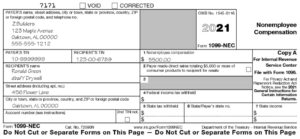

1099 form is an official document of the IRS. It is used by taxpayers to provide information to the Internal Revenue Service (IRS) about all of the different types of income they receive during the year outside of their regular salary. This type of income is also referred to as income from non-employment-related sources. Taxpayers need to report all of their outside income to the IRS in order to avoid an audit. They can be income from entrepreneurial work or engagement, interest, dividends from investments, government payments, or compensation for freelance work.

1099 form is an official document of the IRS. It is used by taxpayers to provide information to the Internal Revenue Service (IRS) about all of the different types of income they receive during the year outside of their regular salary. This type of income is also referred to as income from non-employment-related sources. Taxpayers need to report all of their outside income to the IRS in order to avoid an audit. They can be income from entrepreneurial work or engagement, interest, dividends from investments, government payments, or compensation for freelance work.

For the most part, individual taxpayers don’t complete 1099 forms. Payers–financial institutions and small businesses that hire independent contractors– are required to fill out 1099 forms and send them to their payees by early February.

Depending on the source of income, there are various 1099 forms:

- 1099-MISC (Miscellaneous Information) is used by companies or individuals to report various payments that were made during one year.

- 1099-NEC (Nonemployee Compensation) is a form that is given to everyone who is not permanently employed in the company but additionally engaged for a specific job. These include hiring of external associates, paid commissions, rewards, as well as all other compensations for services performed by someone who is not classified as a permanent employee. You receive the 1099-NEC form if you worked as an entrepreneur or external associate (non-employee). The employer is not required to issue you a 1099-NEC form if the earned income was less than $600 during the year, but you are required to report the earned income to the IRS.

- 1099-G (Certain Government Payments) is used by the Internal Revenue Service (IRS) to report different payments from and financial transactions with a government, not including employee wages. Taxpayers receive 1099-G forms if they have received unemployment compensation payments, state or local income tax refunds, or certain other payments from a government or government agency. This form is sent to you by the state institution at your address, at the beginning of the year.

- 1099-DIV (Dividends and Distributions) is a form that shows paid-out shares and capital gains during the year. You will receive a special 1099-DIV form from each company in which you own shares.

- 1099-INT (Interest Income) is a form sent from banks, brokerages and other institutions that have paid you interest over $10 for a tax year.

- 1099-R (Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.) is a form you receive based on paid pensions and private pension insurance. The financial institution issuing this form may calculate for you the taxable portion of the income on this form. You have the right to choose whether the financial institution that pays you the money will calculate the tax, or you will do it yourself.

- 1099-K (Payment Card and Third Party Network Transactions) is a form you receive from your employer for income generated through payment cards.

- 1099-S (Proceeds from Real Estate Transactions) is a form used to report income from the sale or exchange of real estate. This includes transactions consisting of the sale or exchange for money, debts, assets or services of any present or future ownership interest. This form is issued by an intermediary in the transaction (eg a real estate agency). All 1099-S forms must be sent to real estate sellers by February 16th and sent electronically to the IRS by March 31st of each year at the latest.

- 1099-B (Proceeds From Broker and Barter Exchange Transactions) is a federal tax form issued by brokerages and barter exchanges to record customers' gains and losses during a tax year. Individual taxpayers will receive an already filled-out form from their brokers or barter exchange. The information on the 1099-B form includes a description of each asset, the date of purchase and price, the date of sale and price, and the resulting gain or loss. Capital losses are deducted from all capital gains and can be used to reduce taxable income. Brokers issue a 1099-B form for each purchase separately and are required to send it to all clients and the IRS by January 31st at the latest.

- 1099-C (Entitled Cancellation of Debt) form is used to report a canceled or forgiven debt of $600 or more. The lender submits the form to the IRS and to the borrower, who uses the form to report the canceled debt on his or her income tax return. For example, assume you borrow $12,000 and default on the loan after repaying $6,000. If the lender can’t collect the remaining debt from you, said lender may cancel the debt—$6,000, in this example. That amount is reported on Form 1099-C and, in general, is taxable income to you. It’s your responsibility to include the canceled debt on your tax return. If you receive a 1099-C form, check that the information is correct. If not, contact the creditor and request a corrected form.

- 1099 Composite is a consolidated statement that brings together all 1099 forms issued by a financial institution.

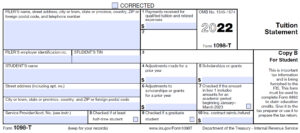

1098-T form is a form that students receive from the educational institutions they attend. The educational institution submits this form for each individual who has been reimbursed or reimbursed for qualified tuition and related expenses.

1098-T form is a form that students receive from the educational institutions they attend. The educational institution submits this form for each individual who has been reimbursed or reimbursed for qualified tuition and related expenses.

Students receive Form 1098-T in order to apply for certain educational loans from the IRS. The 1098-T form is for information purposes only and does not directly define taxable income or credit eligibility.

Every student is required to report paid scholarships to the IRS at the end of the year.

W-2 form is an official tax document also known as the Wage and Tax Statement. An employer is obliged to send this document to each employee and the Internal Revenue Service at the end of the year. A W-2 reports the annual wages of employees and the amount of taxes withheld from their paychecks.

W-2 form is an official tax document also known as the Wage and Tax Statement. An employer is obliged to send this document to each employee and the Internal Revenue Service at the end of the year. A W-2 reports the annual wages of employees and the amount of taxes withheld from their paychecks. 1042-S form shows the income of a nonresident subject to taxation in the USA. It is used to report amounts paid to nonresidents by an institution or company based in the United States.

1042-S form shows the income of a nonresident subject to taxation in the USA. It is used to report amounts paid to nonresidents by an institution or company based in the United States. 1099 form is an official document of the IRS. It is used by taxpayers to provide information to the Internal Revenue Service (IRS) about all of the different types of income they receive during the year outside of their regular salary. This type of income is also referred to as income from non-employment-related sources. Taxpayers need to report all of their outside income to the IRS in order to avoid an audit. They can be income from entrepreneurial work or engagement, interest, dividends from investments, government payments, or compensation for freelance work.

1099 form is an official document of the IRS. It is used by taxpayers to provide information to the Internal Revenue Service (IRS) about all of the different types of income they receive during the year outside of their regular salary. This type of income is also referred to as income from non-employment-related sources. Taxpayers need to report all of their outside income to the IRS in order to avoid an audit. They can be income from entrepreneurial work or engagement, interest, dividends from investments, government payments, or compensation for freelance work. 1098-T form is a form that students receive from the educational institutions they attend. The educational institution submits this form for each individual who has been reimbursed or reimbursed for qualified tuition and related expenses.

1098-T form is a form that students receive from the educational institutions they attend. The educational institution submits this form for each individual who has been reimbursed or reimbursed for qualified tuition and related expenses.